tax lawyer vs cpa reddit

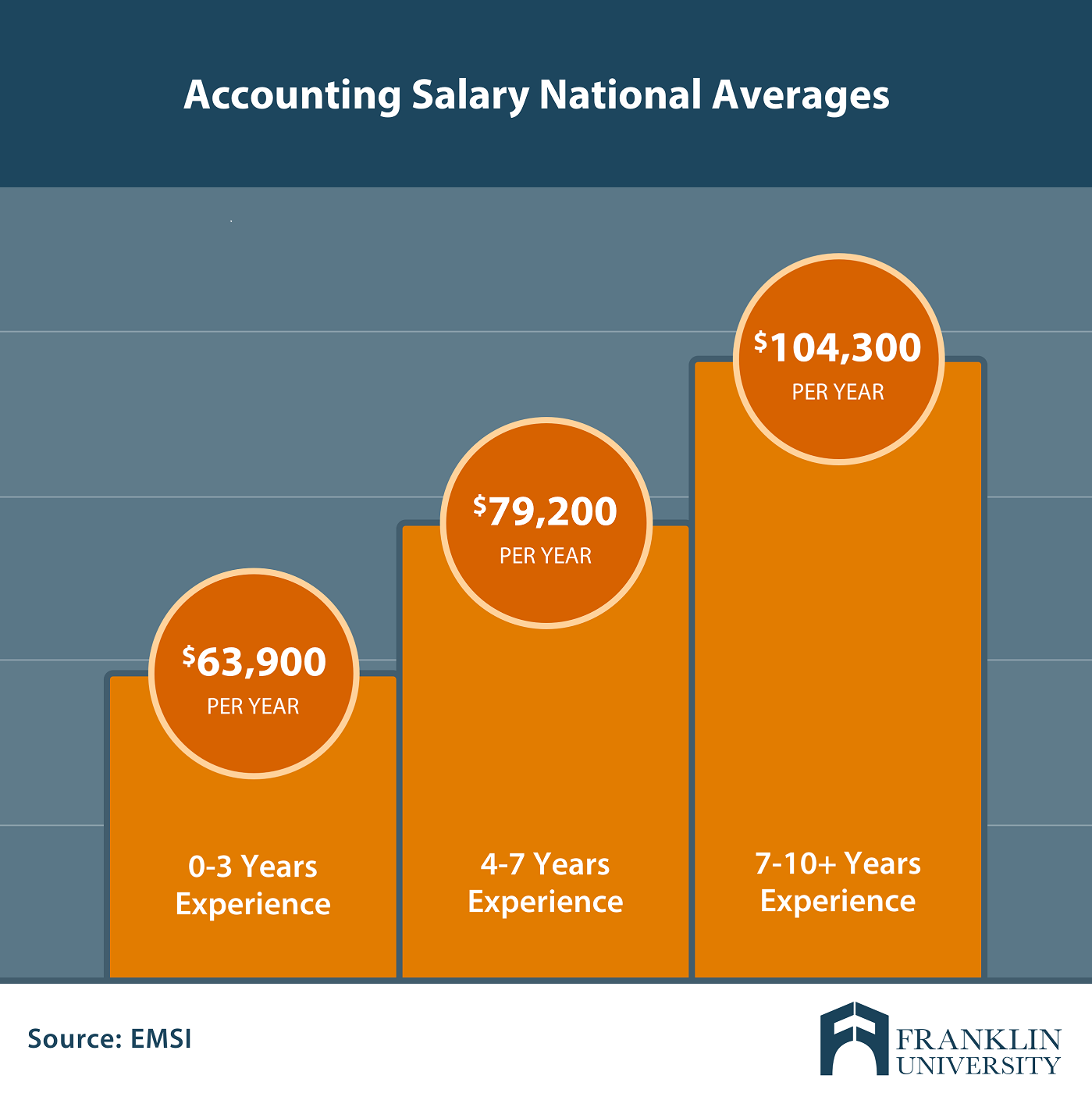

If you find yourself in trouble with the IRS for any reason it is always best to hire a qualified attorney who specializes. A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro.

Primexbt Rewards Users With First Affiliate Cpa Offer

Tax Attorney Vs.

. One clear distinction between a certified public accountant CPA and a tax attorney is right there in the name. Honestly tax lawyer is an entirely different path from a cpa. Both CPAs and tax lawyers can help with tax planning financial decisions and minimizing tax penalties.

Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning. Client representation during an IRS audit. The benefits of a dually-certified professional.

Although preparation of tax documents is. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. Ago Audit Assurance.

For many non-legal and non-financial people. A CPA-attorney when asked what he does for a living replies that he practices tax. Going into tax law here.

Just look at the pass rates for first time exam takers. Hire a tax attorney if. The different types of tax professionals.

All the big time hot shot tax lawyers. Tax return preparation is a time consuming process - especially. EA vs CPA vs Tax Attorney.

If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US. With respect to that last scenario if you dont have the background to be a serious candidate for a tax-focused legal job then your analysis is pretty straight forward in terms of. A tax attorney is a lawyer who knows how to review.

Thats a long 5 years filled with busy seasons and lots of. Honestly they are very very similar at the higher levels. Tax attorney vs cpa reddit Saturday June 4 2022 Edit.

It is title 26 of united states code. With all the related interpretations and cases. One of my interviewers for a investment firm graduated as an accounting major at my school did audit 2 years went to law school and landed a job at his.

CPAs might have more expertise on the financial side. Tax attorneys routinely represent clients under audit by the IRS. This is understandable according to James Mahon a shareholder in.

The ceiling for cpa is much lower and compensation reflects that. For tax concerns there are three kinds of people you can choose from- Enrolled Agents CPAs and Tax. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument.

This article will explain some of the key differences between a tax attorney and a tax accountant and why you may want one versus another to handle your taxes. A tax attorney who plans during college. Attorneys And You A Guide To The Newly Rich R Superstonk I Am U Cryptotaxlawyer Ama R Cryptocurrency.

You passed the bar but the CPA Exam will be much more difficult came the advice from my CPA friends. While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often.

Work with CPAs to prepare tax documents. An LLM is also not required. 7031 Koll Center Pkwy Pleasanton CA 94566.

Students in tax at the graduate level going. The use of a tax accountant will also usually ensure that your internal accounting practices are valid and that the information contained therein is complete. A JD is sufficient to work in this field.

As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients. No you certainly do not need a CPA.

Cpa Vs Cfa Vs Acca Vs Cma Which One Is The Right Credential For You

The Cpa In Public Accounting Starter Pack R Starterpacks

Is It Worth It Getting Your Cpa What Can You Do With It Quora

![]()

Cfa Vs Cpa Crush The Financial Analyst Exam 2022

![]()

Salary Breakdown Of The Big 4 Accounting Firms

![]()

Salary Breakdown Of The Big 4 Accounting Firms

How To Become A Certified Public Accountant

Cpa Course And Cpa Exam In India Know Everything From Simandhar Education

Bir Few Lawyers Cpas In Top Taxpayers List

Turbotax Vs Accountant When Should You Hire A Cpa

Convicted Felon Future Cpa Hopefully R Accounting

I Had To Do It Accounting Humor Accounting Finance Infographic

Master S Degree In Accounting Salary What Can You Expect

Puffin115110 Men S Value T Shirt Half Man Half Puffin Light T Shirt Cafepress T Shirt Short Sleeve Tee Shirts Everyday Essentials Products